17 Seconds #62 – A Publication For Clients And Other VIPs Of Clocktower.

[Editor’s note: It is good and OK to steal your own material. This info is derived from a longer article that I wrote in connection with Techstars that I first published on LinkedIn and later here.]

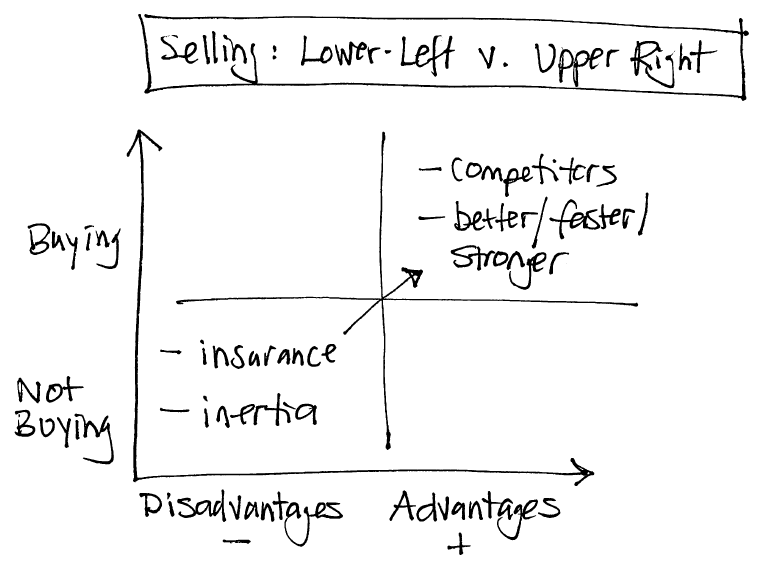

I am a visual thinker and frequently find myself drawing pictures to explain my thoughts. The above picture – illustrating how I learned to think about sales from my mentors – has been in my head for years but not on paper until recently.

This is not an original concept and likely is derived from one of the many business and marketing books I’ve read over the years (likely sources include “Marketing Management” by Kotler and “Selling The Invisible” by Beckwith).

The main idea of the sales drawing is that when you are a startup, or in a new market category (like the iPad), or selling something intangible (like insurance or legal services), then your biggest opponent is not competitors (although you will have competitors). Your biggest opponent is nothing – inertia. Your prospective customers have a choice between buying your new product or doing nothing. And doing nothing is the easiest thing to do! Just ask John Mulaney:

In this time of battling inertia, you will find yourself engaged in “lower left” selling, where your pitch involves the disadvantages of not buying. Don’t want to buy life insurance? Bad things will happen after you die. Later, with more mature products and markets, when competitors are easier to identify, you can move to “upper right” selling, where you focus on the advantages of buying your product, and why your product is better/faster/stronger than your competitor’s product. You must put yourself in your customers’ shoes and think about both types of selling, which may mean AB-testing different pitches.

In short, don’t tell people why your product is better/faster/stronger than competitors’ products. Tell them why buying your product is better than doing nothing!

17 Seconds is a publication for clients and other VIPs of Clocktower Law. Email version powered by MailChimp and the beat of a different keyboard player.